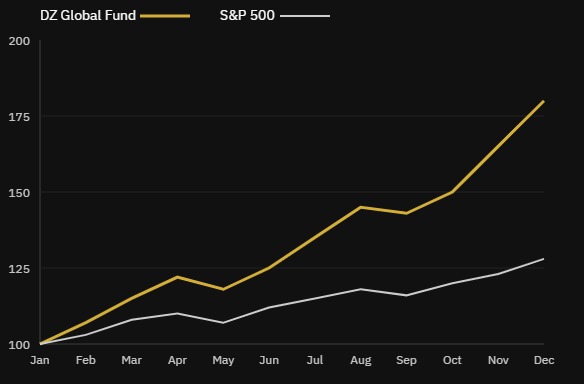

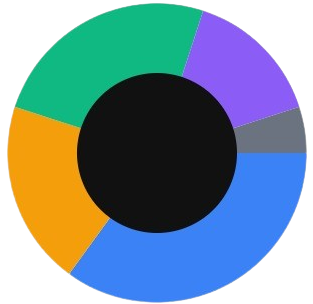

We focus on high-conviction investments in transformative sectors with exponential growth potential. Our proprietary DZ-Algo™ screens 50+ metrics per company to identify tomorrow’s leaders today.

With a minimum investment of $10,000, you can gain access to our carefully curated portfolio of high-growth companies across disruptive sectors.

Fill out our 5-minute form to verify your identity and confirm eligibility.

Choose from multiple payment options including Stripe, PayPal, or wire transfer.

Track performance, view holdings, and access exclusive market insights.

Management Fee: 1.25%

Frais de performance : 10 % au-dessus du S&P 500

Frais de retrait : Aucun

What could your investment become in the future?

Meet the visionaries behind DZ Global Fund. Our team combines deep industry expertise, quantitative excellence, and on-the-ground presence in emerging markets.

Director of Operations

Seasoned operational leader with 20+ years in strategic management. Expertise in scaling high-performance teams and optimizing investment workflows. At DZ Global Fund, I ensure our portfolio companies receive unparalleled operational support while maintaining investor transparency.

Directeur des investissements

Former hedge fund manager with expertise in emerging markets and disruptive technologies. Pioneered our proprietary DZ-Algo™ investment framework that has consistently outperformed market benchmarks.

Head of African Investments

Nairobi-based fintech expert who built three successful startups before joining DZ Global Fund. Intimate knowledge of African markets and deep connections with local entrepreneurs.

Explore our research on transformative technologies and market opportunities that are reshaping industries and creating generational investment opportunities.

Sector concentration – mitigated by our dynamic hedging strategies and diversification across multiple high-growth themes. We continuously monitor market conditions and adjust allocations to manage risk while maintaining strong growth potential.

Monthly liquidity, no penalties. We designed our fund with investor flexibility in mind, allowing monthly redemptions without any early withdrawal penalties.

We charge a 1.25% management fee and a 10% performance fee above the S&P 500. This aligns our incentives with your success – we only earn the performance fee when we outperform the broader market.

Our proprietary DZ-Algo™ screens 50+ metrics per company, allowing us to identify opportunities others miss. We combine quantitative analysis with deep sector expertise and on-the-ground presence in emerging markets.

Currently, we accept investments from accredited investors in the United States and qualified investors internationally. We’re working on expanding accessibility as regulations permit.